Some Ideas on G. Halsey Wickser, Loan Agent You Need To Know

Table of ContentsG. Halsey Wickser, Loan Agent Things To Know Before You Get ThisHow G. Halsey Wickser, Loan Agent can Save You Time, Stress, and Money.The 20-Second Trick For G. Halsey Wickser, Loan AgentG. Halsey Wickser, Loan Agent - An OverviewSome Known Questions About G. Halsey Wickser, Loan Agent.

They might bill funding source charges, in advance costs, financing management costs, a yield-spread premium, or just a broker payment. When collaborating with a mortgage broker, you must clarify what their charge structure is early on while doing so so there are not a surprises on closing day. A home mortgage broker generally only makes money when a loan shuts and the funds are launched.The majority of brokers do not cost customers anything in advance and they are normally risk-free. You need to make use of a mortgage broker if you want to locate accessibility to home mortgage that aren't easily marketed to you. If you don't have remarkable credit score, if you have a special borrowing circumstance like owning your very own business, or if you simply aren't seeing mortgages that will certainly help you, after that a broker may be able to obtain you accessibility to fundings that will be helpful to you.

Home loan brokers might also have the ability to aid finance hunters certify for a lower passion rate than a lot of the business car loans offer. Do you require a mortgage broker? Well, dealing with one can conserve a borrower time and initiative throughout the application procedure, and potentially a great deal of cash over the life of the finance.

Some Known Incorrect Statements About G. Halsey Wickser, Loan Agent

An expert mortgage broker stems, discusses, and processes household and business home loan in behalf of the client. Below is a 6 factor guide to the solutions you should be supplied and the expectations you should have of a professional mortgage broker: A home mortgage broker provides a variety of mortgage financings from a variety of various loan providers.

A home mortgage broker represents your rate of interests instead than the interests of a borrowing organization. They need to act not only as your representative, but as a knowledgeable expert and trouble solver - Mortgage Broker Glendale CA. With accessibility to a vast array of mortgage items, a broker is able to supply you the best worth in terms of rates of interest, payment quantities, and lending items

Several situations demand greater than the basic use a 30 year, 15 year, or adjustable rate mortgage (ARM), so cutting-edge mortgage techniques and advanced remedies are the advantage of collaborating with a skilled home loan broker. A home mortgage broker browses the customer via any situation, managing the procedure and smoothing any type of bumps in the roadway along the road.

The 30-Second Trick For G. Halsey Wickser, Loan Agent

Customers who locate they require larger finances than their financial institution will certainly authorize likewise advantage from a broker's knowledge and capacity to effectively acquire financing. With a mortgage broker, you just need one application, instead of finishing types for every private loan provider. Your mortgage broker can give an official comparison of any car loans recommended, leading you to the info that precisely portrays price differences, with current prices, points, and closing expenses for each financing mirrored.

A reputable home mortgage broker will disclose just how they are paid for their solutions, in addition to information the overall prices for the finance. Customized solution is the distinguishing factor when choosing a home mortgage broker. You should expect your home loan broker to aid smooth the method, be readily available to you, and recommend you throughout the closing procedure.

The journey from dreaming regarding a brand-new home to in fact owning one may be filled up with obstacles for you, especially when it (https://www.whatsyourhours.com/united-states/financial-services/g-halsey-wickser-loan-agent) involves protecting a mortgage in Dubai. If you have been assuming that going right to your financial institution is the finest route, you may be missing out on out on an easier and possibly a lot more useful option: dealing with a home mortgages broker.

The Of G. Halsey Wickser, Loan Agent

One of the substantial advantages of utilizing a home loan expert is the professional monetary advice and crucial insurance policy guidance you get. Home mortgage professionals have a deep understanding of the various economic products and can aid you choose the appropriate mortgage insurance coverage. They ensure that you are properly covered and supply advice customized to your economic situation and lasting objectives.

A home mortgage brokers take this problem off your shoulders by managing all the paperwork and application procedures. Time is cash, and a mortgage car loan broker can conserve you both.

This suggests you have a much better chance of finding a mortgage financing in the UAE that perfectly fits your requirements, consisting of specialized items that could not be offered with typical banking networks. Navigating the home mortgage market can be confusing, especially with the myriad of items offered. A provides expert advice, helping you recognize the pros and disadvantages of each alternative.

Things about G. Halsey Wickser, Loan Agent

This specialist recommendations is very useful in safeguarding a mortgage that aligns with your monetary objectives. Home mortgage consultants have developed partnerships with numerous loan providers, providing considerable working out power. They can protect better terms and rates than you could be able to obtain on your own. This negotiating power can bring about substantial financial savings over the life of your home loan, making homeownership much more economical.

Scott Baio Then & Now!

Scott Baio Then & Now! Taran Noah Smith Then & Now!

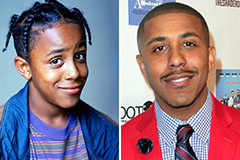

Taran Noah Smith Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Michael C. Maronna Then & Now!

Michael C. Maronna Then & Now! Raquel Welch Then & Now!

Raquel Welch Then & Now!